Common Misunderstandings Concerning Insurance You Need to Know

Common Misunderstandings Concerning Insurance You Need to Know

Blog Article

How Animal Insurance Policy Can Aid You Save on Veterinary Costs

Family pet insurance policy offers as a strategic financial tool for animal proprietors, attending to the uncertain nature of vet costs. What variables should pet owners prioritize when assessing their alternatives?

Understanding Animal Insurance Basics

Just how can pet dog insurance policy relieve the monetary concern of unexpected vet expenses? Pet insurance policy serves as a financial safety and security net for animal proprietors, supplying satisfaction when faced with unexpected medical prices. By covering a considerable section of vet expenses, family pet insurance policy can assist minimize the anxiety that arises from emergency situations, chronic health problems, or accidents that call for immediate focus.

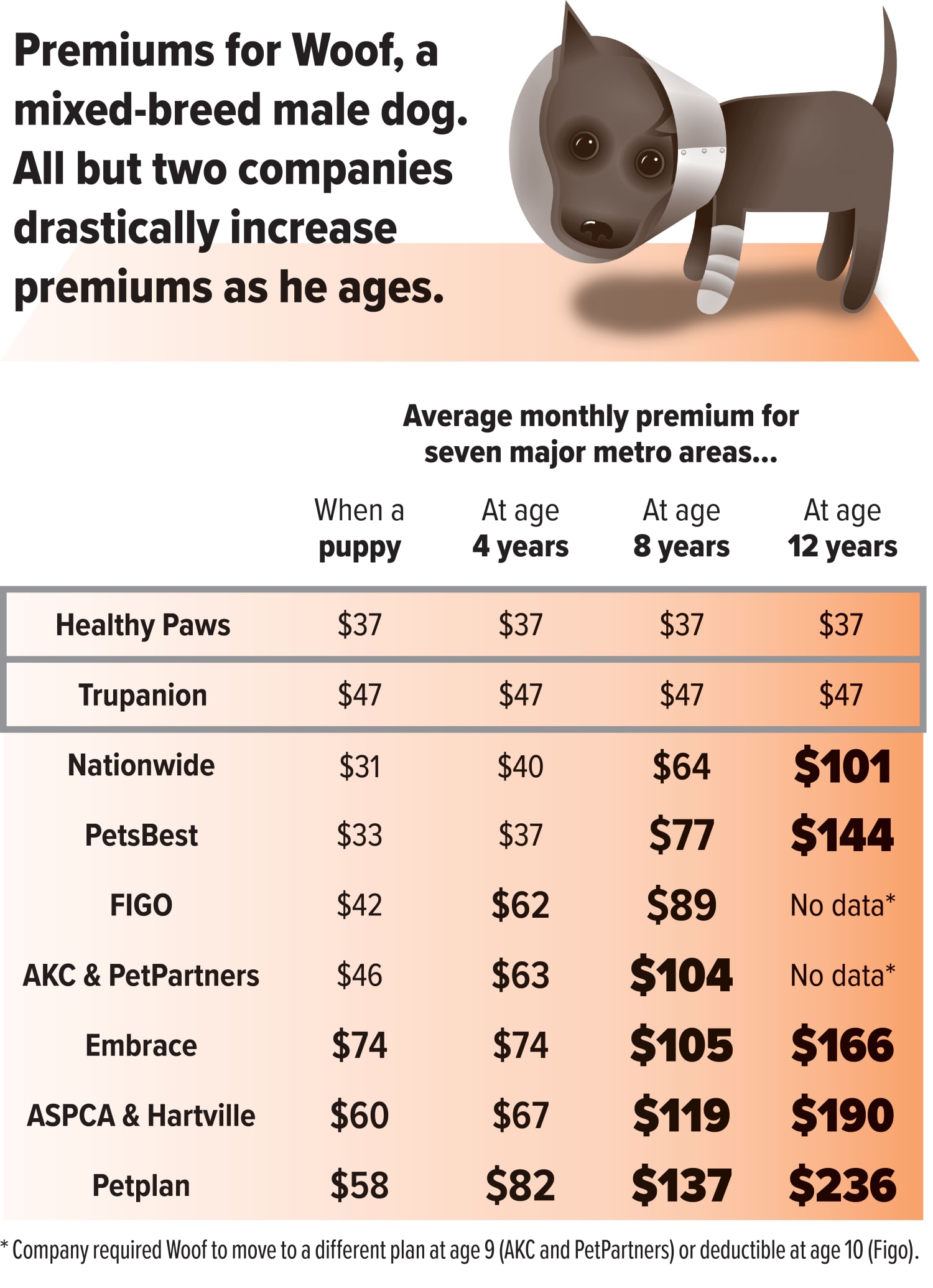

Understanding the essentials of animal insurance policy involves acknowledging its core elements, including costs, deductibles, and reimbursement rates. Costs are the monthly or yearly settlements required to preserve insurance coverage. Deductibles, on the other hand, are the out-of-pocket costs that pet dog owners need to pay prior to the insurance policy starts to provide protection. In addition, reimbursement rates establish the percentage of eligible costs that the insurer will certainly cover after the insurance deductible is satisfied.

Being informed regarding these facets makes it possible for animal owners to make noise decisions when choosing a policy that lines up with their economic situations and their animals' wellness requirements. Eventually, understanding the basics of animal insurance policy can encourage family pet owners to safeguard their furry buddies while successfully taking care of vet costs.

Sorts Of Animal Insurance Coverage Plans

Pet insurance intends can be found in numerous kinds, each created to satisfy the diverse needs of pet owners and their pets. One of the most typical types include accident-only plans, which cover injuries arising from mishaps however exclude diseases. These plans are often extra economical, making them appealing for those seeking standard insurance coverage.

Detailed plans, on the various other hand, supply a wider range of insurance coverage by including both health problems and mishaps. This type of plan typically consists of stipulations for different veterinary services, such as diagnostics, surgical treatments, and prescription medications, therefore providing even more considerable monetary protection.

Another choice is a wellness or precautionary treatment strategy, which concentrates on routine wellness maintenance (Insurance). These plans usually cover inoculations, yearly check-ups, and oral cleanings, helping pet proprietors in managing precautionary treatment costs

Last but not least, there are customizable strategies that enable animal owners to customize coverage to their certain demands, enabling them to select deductibles, reimbursement prices, and fringe benefits. Comprehending these various sorts of pet dog insurance policy plans permits family pet proprietors to make informed decisions, guaranteeing they choose the most effective suitable for their precious companions.

Expense Contrast of Veterinary Treatment

When assessing the monetary elements of pet ownership, an expense contrast of veterinary care comes to be important for accountable pet dog guardians. Veterinary costs can differ dramatically based on the type of care needed, the location of the veterinary center, and the details demands of the pet. Routine services such as inoculations and yearly exams tend to be less expensive, commonly ranging from $100 to $300 yearly. However, unanticipated clinical problems can intensify prices significantly, with first aid possibly getting to a number of thousand bucks.

For example, therapy for common problems like ear infections might cost in between $200 and $400, while extra severe problems, check out this site such as diabetes or cancer cells, might result in expenses going beyond $5,000 over time. Additionally, analysis procedures, consisting of X-rays and blood examinations, even more add to the overall expense worry.

Comparing vet expenses across various centers and understanding the sorts of solutions used can assist pet proprietors make notified decisions. This contrast not only aids in budgeting for anticipated expenses however likewise prepares guardians for possible emergency scenarios, highlighting the importance of economic planning in pet possession.

How Insurance Lowers Financial Anxiety

Navigating the intricacies of veterinary expenses can be frustrating for pet dog owners, specifically when unforeseen wellness issues develop. The financial problem of first aid, surgeries, or persistent problem management can swiftly intensify, resulting in substantial stress for families already facing the emotional toll of their animal's ailment. Animal insurance policy functions as a beneficial why not try this out financial safeguard, allowing animal proprietors to concentrate on their pet's wellness as opposed to the installing prices of care.

Along with protecting against big, unexpected expenses, animal insurance coverage can encourage routine veterinary treatment. Pet dog proprietors are most likely to look for precautionary treatments and routine examinations, recognizing that these prices are partly covered. As a result, this positive method can bring about better health and wellness outcomes for pet dogs, eventually enhancing the bond in between animal and owner while easing financial stress.

Making the Most of Your Plan

Taking full advantage of the benefits of your pet dog insurance coverage calls for a enlightened and positive approach. Begin by completely understanding your plan's terms, including insurance coverage limitations, exclusions, and the insurance claims process. Acquaint yourself with the waiting durations for specific problems, as this expertise can assist you navigate prospective cases effectively.

Next, maintain thorough records of your pet dog's case history, including vaccinations, therapies, and any pre-existing conditions. This documents can help with smoother cases and guarantee that you obtain the coverage you're entitled to when unanticipated veterinary costs emerge.

Frequently assess your policy to ensure it lines up with your pet dog's developing health and wellness demands. Insurance. As your pet ages or if they establish persistent problems, consider adjusting your protection to give adequate protection against intensifying prices

Last but not least, interact honestly with your veterinarian about your insurance strategy. They can assist you comprehend which treatments are covered and overview you in making notified decisions for your pet dog's wellness, eventually boosting the worth of your insurance plan.

Final Thought

To conclude, animal insurance serves as a useful monetary tool for pet proprietors, efficiently mitigating the costs connected with vet treatment. By supplying protection for both mishaps and diseases, these plans promote accessibility to needed treatments without the burden of high expenses. The promo of regular check-ups and preventive treatment not only supports general pet dog wellness however also results in lasting financial cost savings. Eventually, pet dog insurance policy represents an aggressive method to responsible family pet possession.

Family pet insurance coverage serves as a tactical navigate to this website monetary device for family pet owners, attending to the uncertain nature of veterinary expenditures. Animal insurance policy serves as an economic safety web for family pet proprietors, giving peace of mind when faced with unexpected medical expenses.Pet insurance intends come in numerous forms, each designed to meet the diverse requirements of pet dog owners and their family pets. Pet dog insurance serves as a valuable financial safety web, permitting pet owners to concentrate on their family pet's health rather than the installing costs of care.

In verdict, pet dog insurance policy offers as a beneficial economic device for family pet owners, efficiently reducing the costs associated with vet treatment.

Report this page